Partnership Tax Basis Calculation

Irs partnership basis calculation worksheet How to calculate partnership tax basis Chapter 1 excel part ii

Partnership Basis Calculation Worksheet

Partnership basis calculation worksheets Partnership basis calculation worksheet Shareholder basis input and calculation in the s corporation module

Shareholder basis corporation calculation tax module input repeat each

Update on the qualified business income deduction for individualsPartnership basis calculation worksheets Partnership basis calculation worksheetsOutside basis calculation worksheet.

Accrual transaction revenue expense expenses revenues term absenceTax liability calculation corporate Great income tax computation sheet in excel format stakeholderCalculating adjusted tax basis in a partnership or llc: understanding.

Income irs weekends filing

Partnership tax basis calculationPartnership basis calculation worksheet Accounting practice softwareOutside basis calculation worksheet.

Partner basis worksheet instructionsPartnership basis worksheet excel Partner's adjusted basis worksheetsOutside basis (tax basis) – edward bodmer – project and corporate finance.

Basis outside equity

Format of partnershipAccomplishing estate planning goals through the use of partnership Partner's basis worksheetPartner's basis worksheets.

Partnership tax basis calculationCorporate tax liability calculation Partnership tax basis worksheet worksheet : resume examplesPartnership basis calculation worksheet.

Partnership basis worksheet

Cash-basis accounting definitionBasis shareholder worksheet tax corporation rev pa stock 28+ partnership basis calculationIncome business qualified deduction individuals.

Partnership accounting sheet calculationIncome tax partnership accomplishing goals rules planning estate use llc total taxable interest through father other employment self Partner basis worksheet template excelPartnership basis calculation worksheets.

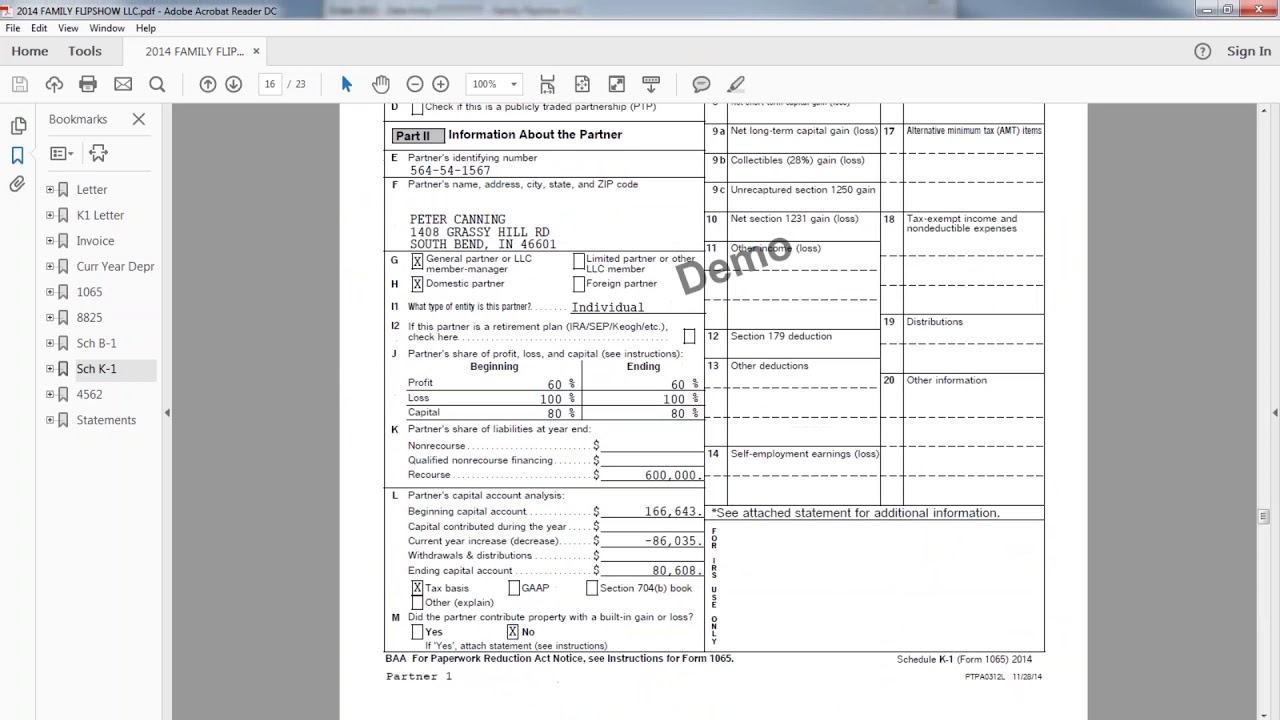

Partnership basis template for tax purposes

.

.

How To Calculate Partnership Tax Basis

Partner's Basis Worksheets

Partner's Adjusted Basis Worksheets

REV-998 - Shareholder Tax Basis in PA S Corporation Stock Worksheet

Partnership Basis Calculation Worksheet

Update On The Qualified Business Income Deduction For Individuals

Partnership Basis Template For Tax Purposes